Dear friends,

Thanks so much for your patience. Chip and I spent a couple of weeks in the Scottish Highlands and Shetland Islands, and we knew in advance that that would slightly delay our August launch. Little did we understand the depth of Scottish generosity, as our hosts shared a case of COVID with us as we left the country. (It felt just like 2021 again!) The illness left us completely drained and endlessly exhausted, respectively. But we’ve now rallied and are delighted to share August with you.

Tips for a Highlands adventure

-

Go to the Highland Chocolatier in Grant Tully (pronounced “Grantly”). Iain Burnett has repeatedly been recognized for the best chocolates or best chocolate truffles in the world. Grant Tully is so small that it would need to triple in size to earn the designation “flyspeck.” It’s just up the road from the market town of Pitlochry, which, Rick Steves assures us, is “an old Gaelic word for ‘tourist trap.'”

Yeah, pretty much. But really, Highland Chocolatier:

-

Go back to the Highland Chocolatier

That’s “All Things Chocolate”: hot velvet ganache served as hot chocolate, along with a slice of chocolate cake, chocolate truffle of your choice, and a pot of exceptional coffee.

-

Follow up with a visit to The (Original) Cake Fridge. The Cake Fridge is an extension of a small café and bakery in Bixter, Shetland. It’s stocked 24/7 with bakery delights and operates entirely on an honor system. You wander up, take stuff, leave money, munch on!

-

Recover with a relaxing afternoon tea in Cullen. Cullen is the home of Cullen Skink, a delightful fish chowder, a soaring viaduct, some stunning art …, and afternoon tea.

Do you sense a recurrent theme here?

-

Bring layers. The daytime highs, at the height of summer, were 60-62 degrees F / 15 degrees C. The wind is almost constant, and light rain is a nearly daily occurrence.

The Shetlands, in particular, are a land without trees or shrubs. Except in-town or around the occasional farmstead, there is no plant taller than about eight inches.

Thin soil, constant (!) wind, storm-wracked seasons, and short summers (they’re at 60 degrees north latitude) conspire to produce a landscape that’s simultaneously desolate and beautiful.

-

Give up on dodging haggis. It’s even in the potato chips.

-

Eat cheese. And strawberries.

Doesn’t that seem like a healthy hint? We visited the Gourmet Cheese Co. in Aberdeen and heartily approved of their Prima Donna Maturo and their attitude, summarized by the mantra “nothing sells like samples.”

If you’re there mid-summer, you’re going to hear, “Scottish strawberries are the best in the world.” A lot. It turns out they’re right. The strawberries from the Co-op Grocery in Lerwick, capital of Shetland, were better than any we’ve grown at home. Better than any we’ve eaten anywhere. Bright red all the way to the center, sweet and fragrant. We’ve officially placed our grocery store’s freakish Driscoll strawberries on the same “do not fly” list as those mid-winter tomatoes that get strip-mined in Texas and shipped north.

-

Bring hiking shoes, and explore ruins. In the Highlands, every town seems to have the ruins of a medieval church, cathedral, or monastery. Chip celebrated, in particular, the opportunity to climb a four-story tall spiral staircase – with some of the steps created from recycled gravestones – up the south tower of the Elgin Cathedral.

The other striking feature was the abandoned cottages, about one every tenth of a mile; something between the outline of a foundation in stone up to four stone walls, chimney but no remaining rooms, doors, or windows. To some extent, that’s a reminder of the hated Highland Clearances in the mid-18th and again in the mid-19th centuries when the Scottish lairds and the English nobility made most of the country homeless.

-

Celebrate anonymity. At least as you pass them on the streets, the Scots make New Yorkers seem like gregarious Minnesotans.

-

Celebrate each other. There is no greater gift than time and company and no better time to celebrate it than now.

In the August Mutual Fund Observer …

For folks who’d prefer that we get back down to business, Devesh shares his conversations with three exceptional investors:

- Andrew Foster, on the incoherence of “emerging markets” and how to profit anyway

- Amit Wadhwaney, on life beyond Artificial Intelligence, Cryptocurrency, Quantum Mechanics, Electric Vehicles, Virtual Reality, and Social Media

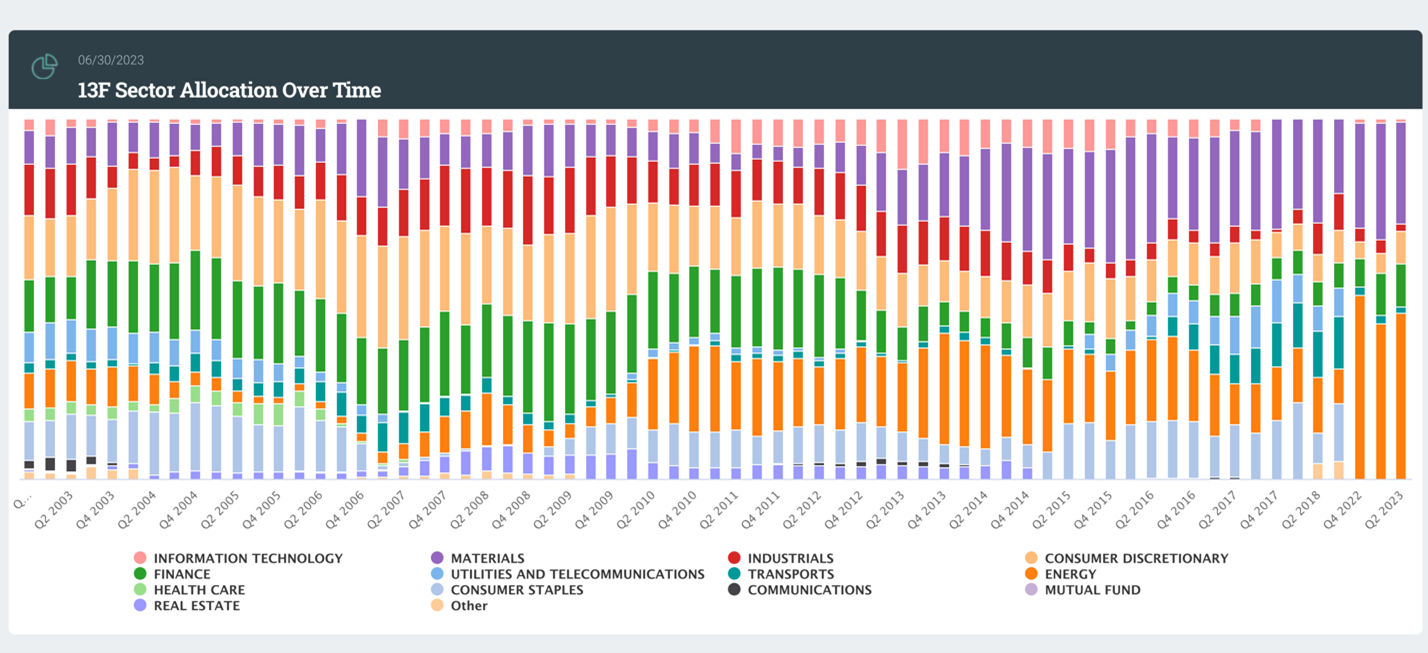

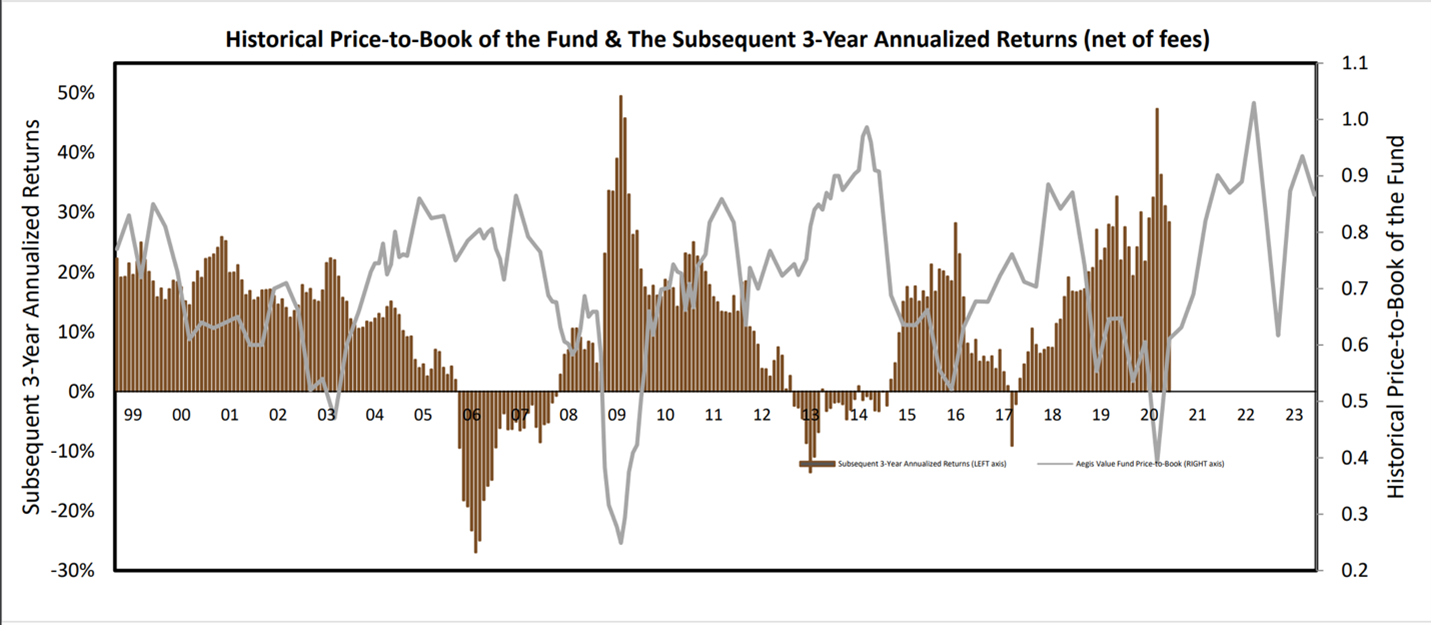

- Scott Barbee, the most successful small cap value investor of the past quarter century, on the prospect of a once-in-a-lifetime opportunity in small cap energy.

Lynn Bolin shares the evidence that might guide Vanguard investors’ next chapter.

We note, with sadness, the passing of Robert Bruce of the Bruce Fund. His death, and the MFO Discussion Board’s reflection on it, give occasion for an extended look at the question: “What happens if your manager gets hit by a bus?” We look at the fate of a half dozen funds (from Nicholas to Bruce) in the years after the departure of “the name on the door.” Even with two side trips into the fate of the Mathers Fund and Fasciano Fund, the evidence is reassuring.

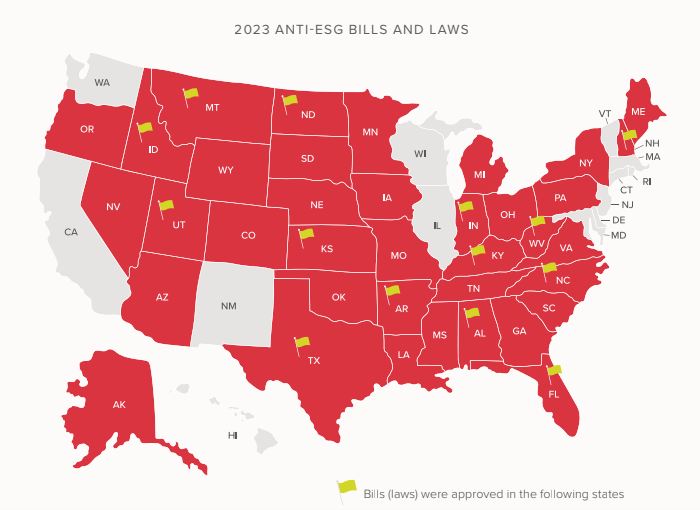

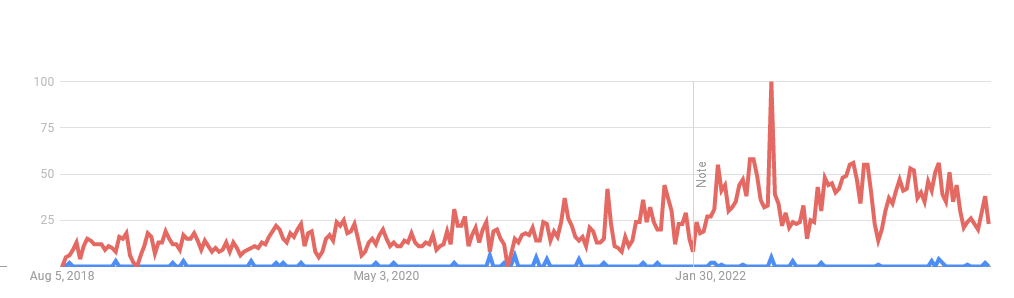

That’s complemented with an examination of greenhushing – the desperate desire of corporations and investors to pretend they’re not interested in the environment (after a decade of desperate efforts to pretend they were), a Launch Alert for RiverPark Small Cap Growth, two-point-five exceptional funds in the pipeline, and The Shadow’s review of the industry’s top news.

Beyond that, several quick hits.

On Morningstar’s Radar

Morningstar maintains a “prospects list,” which are the strategies that maybe, someday, will warrant their analysts’ full attention. In July, the Morningstar Prospects list was revised to add a half-dozen promising funds.

- American Funds Emerging Markets Bond Fund adopts a blended approach between hard and local-currency emerging-markets debt, which sets it apart from most hard currency-focused peers.

- Dimensional U.S. High Profitability ETF launched in early 2022 and offers investors exposure to the market’s most profitable companies.

- Driehaus Small Cap Growth‘s veteran leadership use a tested approach focusing on inflection points to find mispriced small growth stocks.

- iShares Fallen Angels USD Bond ETF offers investors exposure to a historically high-performing section of the high-yield bond market.

- Lazard International Quality Growth launched in 2018 and offers investors exposure to high-quality, large-cap companies around the world.

- Vanguard Emerging Markets Bond Fund‘s experienced managers run a sensible process at a bargain price.

And, likewise, a bunch of Prospect List members just became former Prospect List members:

- iShares ESG Aware Target Allocation Series viability is in question because it has failed to gain assets in two years since launch; two of the exchange-traded funds have less than $10 million.

- JOHCM Global Income Builder was liquidated in May because it failed to gather assets. (A bit. We wrote favorably of the strategy.)

- Hartford Small Company has a new, untested manager, Ranjit Ramachandran, following the departure of Steven Angeli, who was responsible for the strategy’s earlier success.

- Nuveen ESG Small-Cap ETF, Schwab Municipal Bond ETF, RPAR Risk Parity, and WisdomTree Emerging Markets ex-State-Owned Enterprises Fund were all booted for being boring and unimpressive.

FPA Crescent celebrates its 30th anniversary

Congratulations to Steve Romick and the team at FPA for a remarkable 30-year run for FPA Crescent. Crescent seeks to generate “equity-like returns over the long-term, take less risk than the market and avoid permanent impairment of capital.” That strategy is opportunistic and has a strong absolute value bent; that is, the managers would prefer to hold cash rather than put their shareholders at risk of “permanent impairment” by investing in overvalued securities. Currently, the fund holds 27% of its assets in cash.

Over the 30 years since launch, Crescent has virtually matched the total returns of the S&P 500 (Morningstar calculates that $10,000 at inception is now worth $169,700; the same investment in the S&P 500 would have grown just $1,300 more, to $171,000) with a tiny fraction of the volatility (FPA captures about 54% of the S&P 500’s downside).

Comparison of Lifetime Performance (07/1993-07/2023)

| APR | MAXDD | Recvry mo | STDEV | DSDEV | Ulcer Index | Sharpe Ratio | Sortino Ratio | Martin Ratio | |

| FPA Crescent | 9.8 | -28.8 | 22 | 11.0 | 7.3 | 6.1 | 0.68 | 1.03 | 1.23 |

| Flexible Portfolio Category Average | 7.5 | -37.0 | 52 | 10.9 | 7.5 | 9.0 | 0.48 | 0.70 | 0.65 |

| S&P 500 | 10.1 | -51.0 | 53 | 15.1 | 10.3 | 14.7 | 0.52 | 0.76 | 0.53 |

| FPACX compared to S&P | 97% | 56% | 41% | 73% | 71% | 230% | 130% | 135% | 232% |

By way of full disclosure, FPA Crescent is the largest single holding in my personal portfolio and has been for well over a decade.

Kinetics and Texas Pacific Land Turnaround

Devesh shares the following update on a set of funds that he (and belatedly Morningstar) have worried about: In November 2022’s MFO issue, in the article Kinetics Mutual Funds: Five Star Funds with a Lone Star Risk, we wrote that investors in mutual funds run by Horizon Kinetics Asset Management were exposed to a very successful, but highly concentrated position in Texas Pacific Land. Just one stock, TPL, accounted for 46% of all assets, and that was an illiquid, risky bet.

From the first week of November to the end of June 2023, TPL halved in price from $2700 to $1300 per share. Two of Kinetics’ biggest funds, WWNPX and KSCOX, suffered drawdowns of between 30 and 40 percent. An ugly Board room battle is being fought out in the Delaware Chancery Court between TPL’s Board of Directions and TPL’s shareholders.

August 1st, 2023, will go down as the date in the history of Texas Pacific as the day Murray Stahl of Horizon Kinetics pulled a rabbit out of the hat. The Chairman of the Board of Directors + 1 Director resigned, an implicit victory for the shareholders. In the past week, TPL is up 20% in price, and the two above-mentioned funds are up 10% and 7%, respectively.

This change in the direction of the antiquated Board of Directors of TPL cannot be overstated. It’s going to fundamentally alter TPL’s and Horizon funds’ returns for the better henceforth. Great work by Murray Stahl and the team at Horizon! Still too much concentration risk, but may Lady Luck shine on you once again.

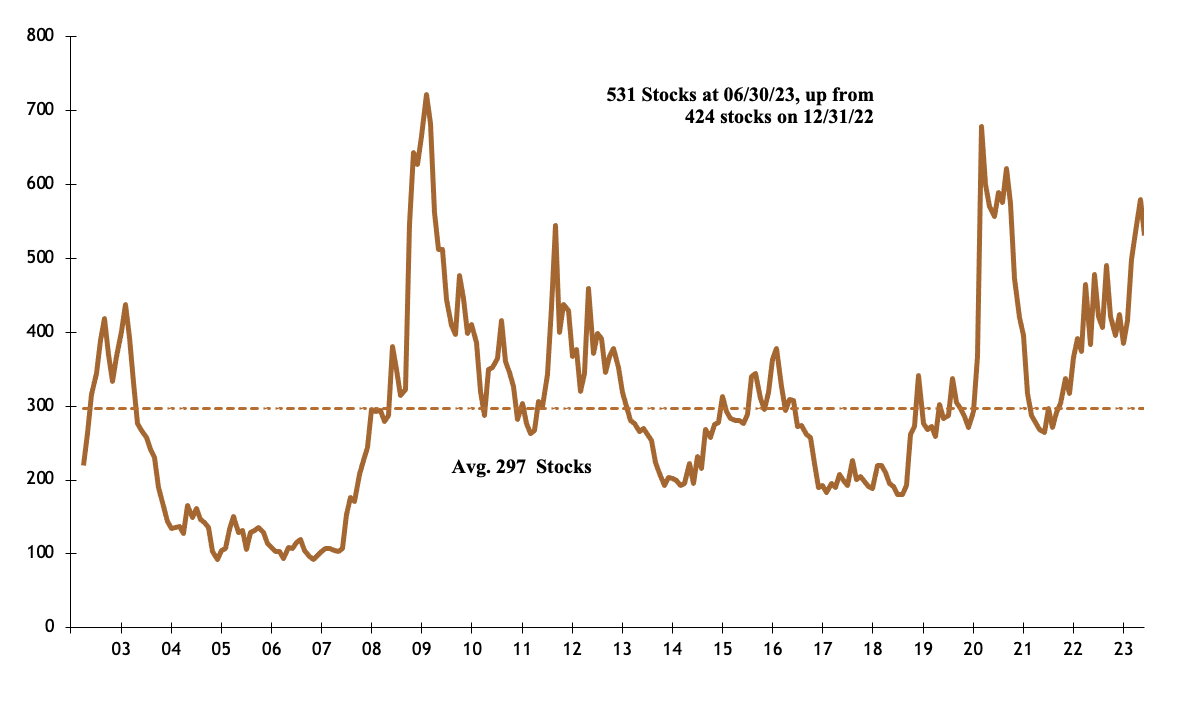

The size of the fund universe is shrinking!

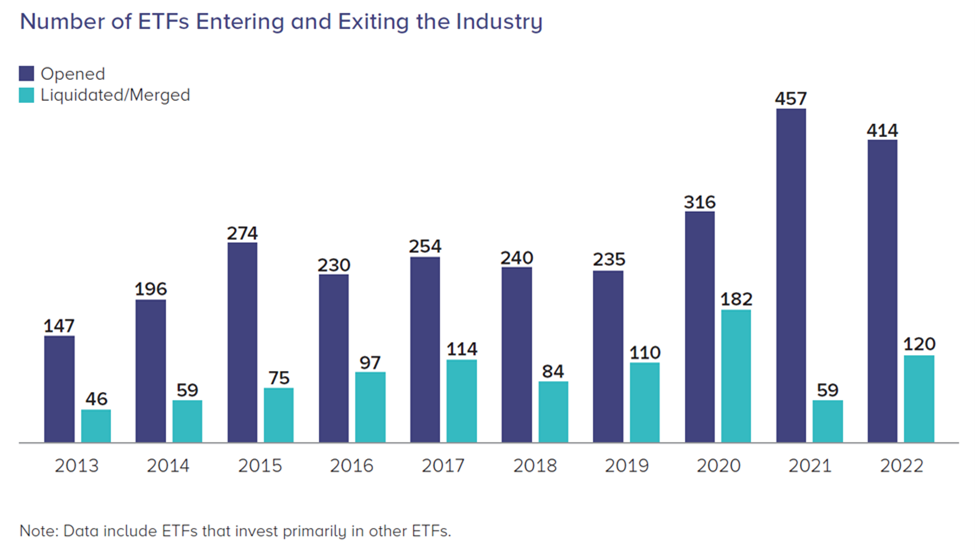

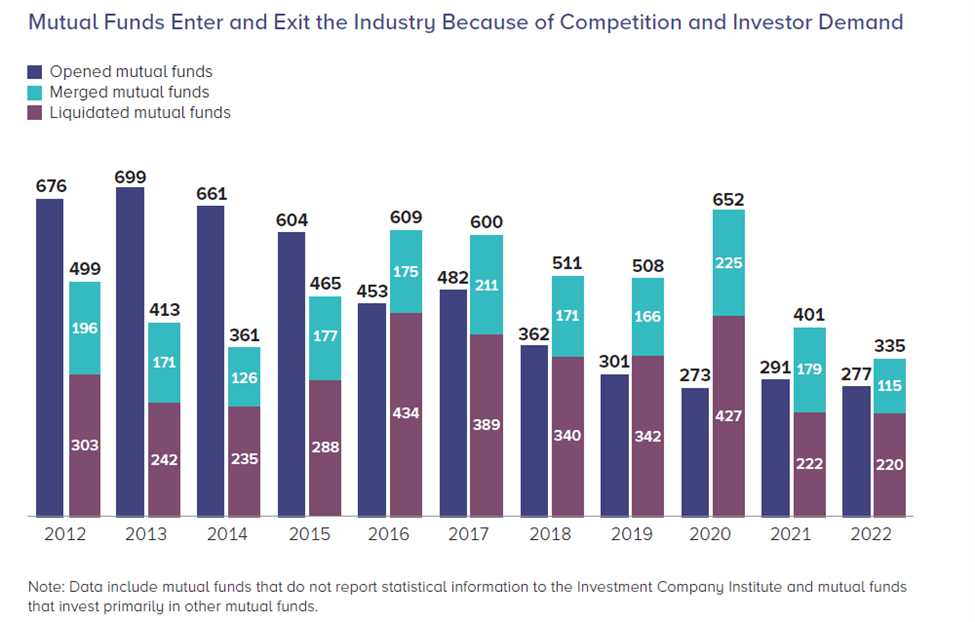

The Investment Company Institute released data on fund and ETF launches and liquidations. The size of the fund universe has contracted every year since 2015, the last time that new fund launches exceeded the number of liquidations and mergers.

At the same time, the number of (mostly utterly unnecessary) ETFs has climbed as launches exceed liquidations and more funds convert to ETFs.

Source: Investment Company Institute Fact Book (2023)

The active ETF space might be on the verge of eruption

Vanguard patented a process for creating an ETF share class of existing mutual funds. As an example, Vanguard Dividend Appreciation Fund is also offered as Vanguard Dividend Appreciation ETF. Being able to create ETFs as a share class involves much less paperwork and administrative trauma while simultaneously allowing the new ETF to import a reported asset base and track record, both of which are important threshold issues for many gatekeepers.

That patent has now expired, allowing other fund companies to freely replicate the strategy. Dimensional Fund Advisors (DFA), which “entered the ETF market less than three years ago and has seen jaw-dropping growth, becoming the largest issuer of actively managed ETFs. Its 31 ETFs have $95bn in assets under management,” has now filed an application with the SEC to allow it to launch ETF versions of its funds (“Dimensional files for Vanguard-style ETF share classes,” Financial Times, 7/14/2023). Emma Boyde, the FT correspondent, foresees that DFA’s success “could mark the start of a revolution in the US funds industry.”

Smart beta, dumb investment

Morningstar published interesting research in July on the performance of so-called “smart beta” ETFs. The traditional index is called cap-weighted: the weight of each company in a particular index is simply a reflection of its stock market capitalization. The company may be a disaster, it may be crazily overpriced, but if market capitalization is huge, it will automatically become the biggest stock in the index.

So people worry that market cap weighting created an undesirable bias toward large cap, growth, and momentum in an index. On the day I’m writing, for example, 25% of the S&P 500 is invested in just six stocks (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Tesla), almost all in the same corner of the economy.

Those concerns gave rise to intensive data mining, all of which sought to answer the question, “What works?” Depending on how you look, dividends work. Value plus momentum works. Small plus quality plus dividend growth works. Deleveraging and growth works. All of those statistical patterns are generated by “back-testing” (“If this were 2003, what combination of facts would give up the best returns between now and 2023?”). Advisors willing to believe that what worked in the past will surely work in the future rolled out an endless stream of so-called “smart beta” ETFs to take advantage of these hidden market mysteries.

Morningstar’s research starts with a laconic, “Yeah, about that …” and finishes with a “not so much.” Emma Boyde in the Financial Times summarizes it this way:

Newly constructed indices often flatter to deceive and rapidly lose the bulk of the ability to outperform they demonstrated in backtesting, according to research from Morningstar.

Based largely on backtested data, a typical new index outperformed its corresponding Morningstar category index by 1.4 percentage points a year during the five years before any fund started tracking it, the researchers found. But that excess total return declined to just 0.39 percentage points a year over the five years after the fund launched. Risk-adjusted performance followed a similar downward trend. (“New indices rapidly lose ability to outperform, study shows,” Financial Times, 7/23/2023, please respect the FT paywall if you encounter one)

For those suffering from insomnia, the original Morningstar research can be accessed here.

I love Marketplace reporting

Marketplace is a suite of daily programs about economics, culture, and politics. That is, they talk about politics through the lens of its interplay with economics. The tone tends to be breezy and accessible, though the analysis and guests are pretty consistently solid and non-ideological. (The lead host, a former Navy fighter pilot, and Foreign Service officer, remains stunned by Mr. Trump and his followers, but that tends not to bleed into coverage the way it might with MSNBC or Fox.)

One recent “that’s cool!” moment was a really clear description of the cause of an imminent crisis in $20 trillion commercial real estate. David Sherman thinks the crisis will be monumental but didn’t walk through the issue. Marketplace did: commercial RE loans are typically for five years. A record number of loans are due for renegotiation in the next year. Almost all of those loans will be at higher rates, and many of those loans will be for smaller amounts. Lenders will grind more on borrowers’ cash-flow assumptions and crisis management plans. In consequence, a bunch of deeply indebted borrowers may have to go into fire sale mode for some of their properties, either slashing rents to maintain near-full occupancy or selling properties for whatever they can recoup. This will not be a good thing.

That walk-through helped a lot.

You might find it worth your time to look into Marketplace. It is not NPR, though, like NPR, it is listener-supported. (I contribute monthly.) The flagship show is Marketplace. The daily chat between hosts is Make Me Smart. The program to help kids understand money is Million Bazillion. The show about how money messes with our lives is “This is Uncomfortable.”

Thanks, as ever …

Thanks most especially to the generosity of the folks behind the Weeks Family Charitable Fund and to the long-suffering OJ, still hounded by Ted’s ghost on the discussion board. To our newest subscriber, Stephen (howdy, sir!), and to The Faithful Few, whose monthly contributions keep spirits up and the lights on: S & F Investment Advisers, Wilson, Brian, Gregory, Doug, David, William, and William.

As ever,

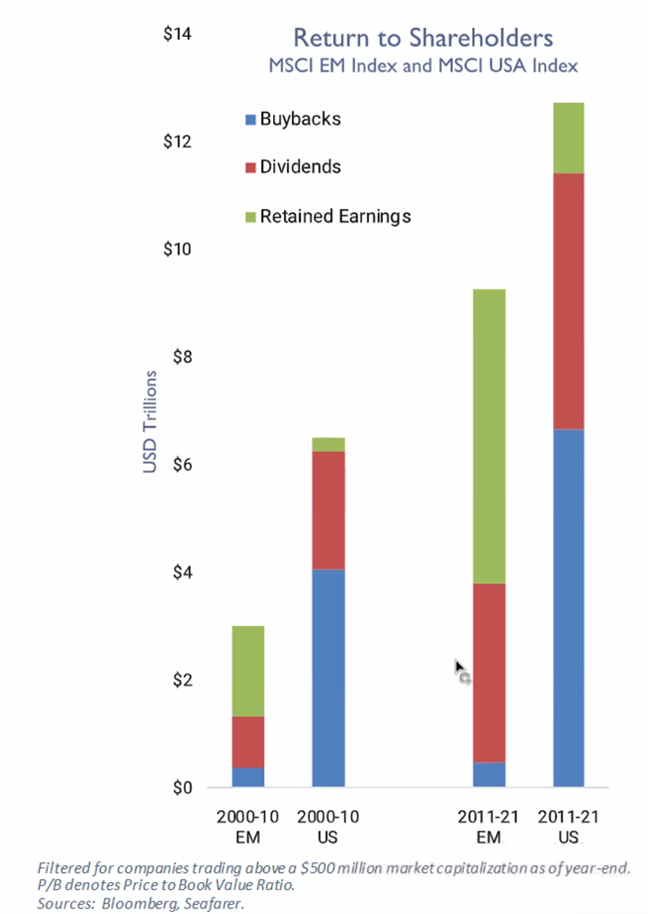

The firm, which was founded by Andrew and Michelle Foster in 2011 … is 100% employee-owned and offers two diversified emerging-market strategies. Andrew Foster, who serves as CIO and as a portfolio manager, is a seasoned and skilled investor with considerable emerging-market expertise. Michelle Foster, who serves as CEO, has a strong resume as well. Seafarer has grown its investment and operations/executive teams wisely over the years—and expanded the roles of several individuals along the way—and the firm is well-staffed overall.

The firm, which was founded by Andrew and Michelle Foster in 2011 … is 100% employee-owned and offers two diversified emerging-market strategies. Andrew Foster, who serves as CIO and as a portfolio manager, is a seasoned and skilled investor with considerable emerging-market expertise. Michelle Foster, who serves as CEO, has a strong resume as well. Seafarer has grown its investment and operations/executive teams wisely over the years—and expanded the roles of several individuals along the way—and the firm is well-staffed overall.